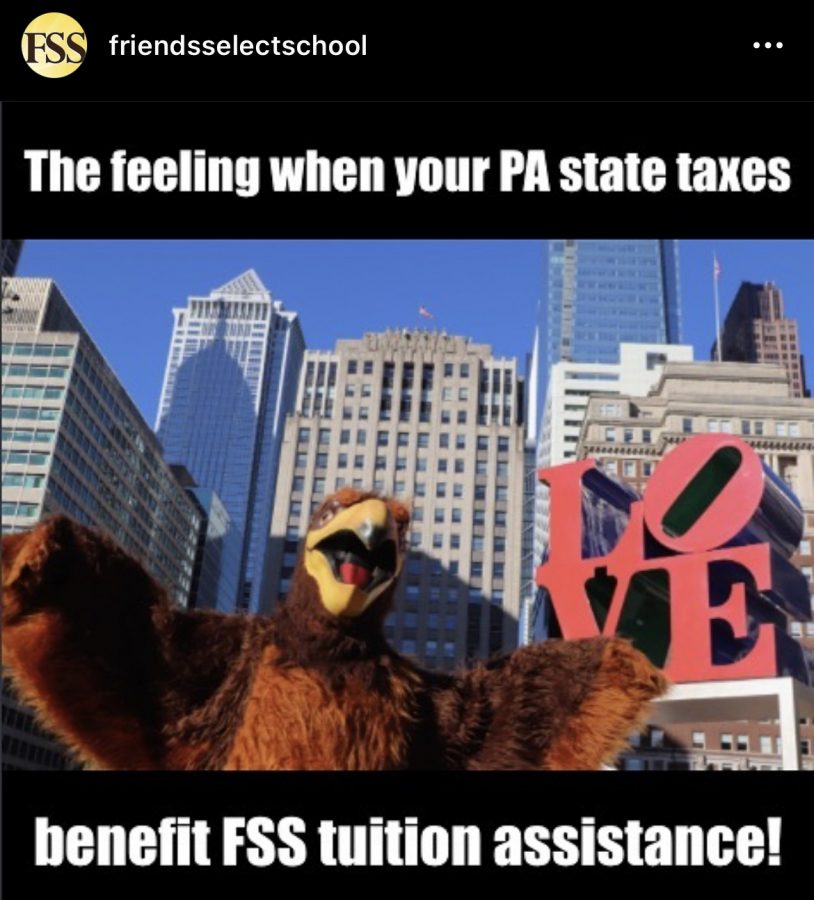

Friends Select’s Participation in Tax Credit Programs: Fair or Foul?

On Thursday, April 15th, Friends Select School’s official Instagram account posted an impact font meme picturing the school’s Falcon mascot with text reading: “The feeling when your PA state taxes benefit FSS tuition assistance.” At first glance, the message appeared nonsensical — how could public tax dollars directly benefit a private educational institution? However, as the post’s caption explained, Friends Select participates in a program called the Educational Improvement Tax Credit (EITC) Program, which allows individuals and corporations to reallocate their state income taxes to private educational institutions. Such programs have a significant financial impact on schools like Friends Select and a controversial reputation in the political world.

Educational tax credit programs replace state income taxes with donations. Mallory Burgan, Friends Select’s Director of Development Services, explains that these donations are made through shell corporations called “special purpose entities” (SPEs), which file the necessary paperwork with the state and give the funds back to the school. Individuals contributing to educational tax credit programs pay their state income taxes automatically through their weekly paycheck, but receive a 90% tax credit for those payments after filing their donation to the tax credit program. They can recoup the other 10% of their state income tax by listing their donation as a charitable contribution in their federal income taxes. This means that if a family pays $10,000 in state income tax and donates $10,000 to Friends Select’s scholarship fund, they receive a $9,000 tax credit from the state and have the opportunity to receive a $1,000 tax credit from the federal government.

In 2021, Friends Select expects to receive approximately $500,000 in tuition assistance from the tax credit program, compared to $480,000 in 2020. These funds come from 43 individuals and 4 businesses, totaling 47 donors through the school’s SPE. Information about how much money the school awards in financial aid from tax credit programs is confidential. According to Mallory, some local private schools bring in millions of dollars through the program, “so the school would like to focus more on the program in the future because there’s so much opportunity.”

To receive EITC funding and distribute financial aid from these donations, schools have to meet strict state requirements. Students receiving EITC-funded financial aid must demonstrate sufficient financial need; another program called Opportunity School Tax Credit requires financial need and residence in the zip code of an underperforming public school.

Mallory says that the school’s participation in the EITC program is designed to increase agency in education for low-income families. “The thought is that by allowing students to attend a school of their choice rather than a school they were assigned to based on where they live, it benefits both the student and the family, and relieves the financial burden of that student from their assigned district,” she says.

Tax credits like the EITC essentially allocate public funds to both public and private schools. These policies are broadly categorized as “school choice” programs, granting low-income families the ability to send their children to schools other than their neighborhood public schools. Although such programs can offer some students an improved education, they can leave other students behind: children whose parents aren’t aware of tax credits or engaged in their academic life cannot benefit from the policy. Additionally, as many observe, neighborhood public schools suffer when talented students and engaged parents flee for private or charter schools.

According to Mallory, such programs were initially open exclusively to corporations. Over time though, selective income tax donation opportunities have been expanded to individuals.

One 2020 op-ed in the Pennsylvania Capital-Star observed that while Philadelphia and other low-performing school districts contained many charter schools, well-reputed districts like Lower Merion had zero. In the columnist’s eyes, school choice is a taxpayer-funded method of depleting and destroying neighborhood schools, leaving low-income students behind while more connected students receive stronger educations.

Conversely, an opinion from the Cato Institute posited that policies favoring school choice give families the agency to access the best possible education for their children. The article argued that school choice programs increased accountability for public education; if local schools can’t provide adequate education, families could take their resources.

The ethics of Friends Select’s participation in educational tax credit programs come down to personal opinion. Depending on who one asks, they can either provide families with critical agency in education or leech important funding from struggling neighborhood schools.